Get your vehicle registered, fast.

California Title Transfer Fees & Taxes 2025 Step-by-Step Guide

California vehicle owners face some of the highest title transfer fees and taxes in the U.S. The state's complex registration system often surprises residents with its costs. Understanding these expenses helps owners make informed decisions about registration strategies.

Vehicle registration in California involves multiple fees, taxes, and requirements beyond basic title transfers. From mandatory emissions testing to steep vehicle license fees, California creates one of the most expensive vehicle ownership environments. Many owners find alternative registration methods that save thousands while remaining legal.

These costs impact all vehicle types, from passenger cars to luxury RVs and classic automobiles. Specialty vehicles face additional complexities that increase expenses. Knowledge of these requirements and alternatives is valuable for vehicle owners in California.

Key Takeaways

Breakdown of California vehicle registration costs and hidden fees.

Special requirements for RVs, classics, and specialty vehicles.

Legal alternative registration strategies to save thousands.

Step-by-step processes for various transfer scenarios.

Cost comparisons showing savings of $5,000 to $15,000.

Understanding California Vehicle Registration Costs

Basic DMV Fees

California's DMV charges specific fees for title transfers. The standard title transfer fee is $15 for private party purchases, typically paid by the buyer, though agreements can vary. Out-of-state title conversions cost $21, and duplicate titles for lost documents are $21. Lien release processing adds $15.

Required documents include a completed bill of sale, mandatory for most transactions. New license plates cost $29, though existing plates can sometimes be retained. Specialty plates, like black license plates, cost an extra $50 initially. Dealership document fees range from $85 to $395, covering paperwork processing, separate from DMV fees.

California's Tax System

California's tax structure significantly increases vehicle registration costs. The base sales tax rate is 7.25%, but local jurisdictions can push rates to 10.25% in areas like Los Angeles County. Sales tax applies to the purchase price or the vehicle's market value (per DMV tables), whichever is higher, for both dealership and private party sales.

The vehicle use tax matches the local sales tax rate and applies to out-of-state or private party purchases where sales tax wasn't collected. It's calculated on the purchase price or market value, whichever is higher. The Vehicle License Fee (VLF) is 0.65% of the vehicle's market value annually. For a $50,000 vehicle, this adds $325 yearly. Registration fees vary by vehicle weight and type, with passenger cars at $46 and larger vehicles like RVs costing more.

Mandatory Emissions and Safety Requirements

California's strict environmental standards add costs. Most vehicles need a smog check before title transfer, costing $30-$50 at certified stations. This applies to gasoline vehicles (1976 or newer) and diesel vehicles (1998 or newer). Exempt vehicles pay an $8 smog transfer fee. Testing requires time for appointments and inspections.

Specialty vehicles, like modified trucks or RVs, face complex smog requirements, sometimes needing specialized stations. Safety inspections may apply to imported or custom-built vehicles, adding time and cost.

Late Transfer Penalties

California enforces strict transfer deadlines. Title transfers must occur within 10 days of purchase or ownership change, or penalty fees start at $25 and increase over time. Late registration adds $15. Driving an unregistered vehicle risks impoundment, fines, or citations.

Vehicle Type-Specific Requirements and Costs

Recreational Vehicles (RVs)

RV owners face high costs due to weight-based registration fees. A 15,000-pound Class A motorhome incurs $200-$300 annually, while luxury coaches over 30,000 pounds may exceed $500 yearly. Smog requirements vary, with some RVs exempt, but inspections for non-exempt vehicles can be complex due to vehicle size.

Cross-state travel complicates matters, as California's requirements are stricter than many RV-friendly states. RVs stored outside California may still face tax obligations based on usage and domicile.

Classic and Collector Vehicles

Vintage vehicles (25 years or older) qualify for historic registration, reducing annual fees to $40, but with restrictions on use (e.g., shows, parades, or maintenance only). Antique vehicles (1922 or earlier) can get permanent registration for $40, with similar limits. Taxes on classics are based on market value, not purchase price, so a $15,000 classic car valued at $35,000 incurs tax on the higher amount. Documentation for authenticity and restoration history adds complexity.

Specialty and Imported Vehicles

Military surplus vehicles, like Humvees, require extensive documentation to meet safety and emissions standards, often costing thousands in compliance work. Imported vehicles need federal compliance documents and inspections, with professional assistance costing $2,000-$5,000. Custom-built vehicles require detailed component documentation and safety inspections. Bonded titles, for vehicles with incomplete ownership records, involve a bond of 1.5 times the vehicle's value and court proceedings.

Gifted Vehicle Transfers

Gifted vehicles incur use tax based on market value, not the gift amount. Limited tax exemptions exist for transfers between spouses, parents and children, or siblings, but require strict documentation (e.g., birth or marriage certificates). Selling for a nominal $1 doesn't reduce tax, as California uses market value. Incomplete paperwork can lead to delays and penalties.

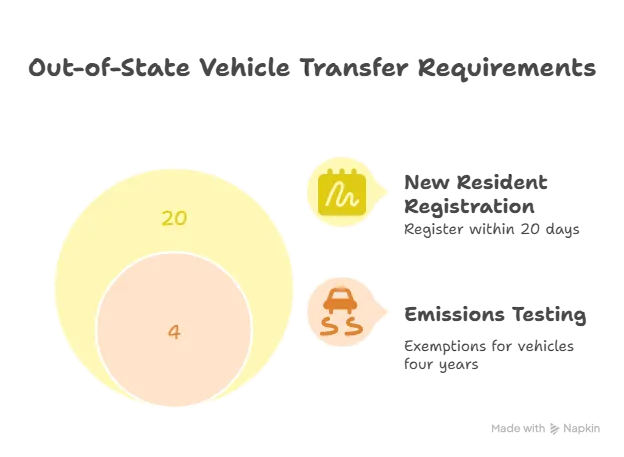

Out-of-State Transfer Requirements

New Resident Registration

New residents must register vehicles within 20 days of establishing residency, determined by factors like employment or school enrollment. Vehicle purchases require title transfer within 10 days. The Vehicle Verification process (Form REG 31) costs $23 and confirms VIN accuracy. Total costs for out-of-state transfers range from $2,000-$5,000, depending on vehicle value and taxes.

Emissions Testing for Out-of-State Vehicles

Most out-of-state vehicles need smog certification ($30-$50), even if not required in the previous state. Newer vehicles (4 model years or less) are exempt but pay the $8 smog transfer fee. Diesel vehicles may need specialized testing. Failed tests require repairs, costing hundreds to thousands. Some RVs and mobile homes may be exempt, based on specifications.

Required Documentation

Out-of-state transfers require the vehicle title, registration, proof of purchase, bill of sale, smog certificate (if applicable), and California-specific insurance. AAA can assist with transfers for members, potentially faster than DMV visits. Processing times vary, with complex cases taking weeks.

Legal Alternative Registration Strategies

LLC Vehicle Ownership

Registering vehicles through a Limited Liability Company (LLC) in states like Montana offers significant savings. Montana has no vehicle sales tax, no annual personal property tax, and no emissions or safety inspections for most vehicles. LLC registration is legal and recognized nationwide. For vehicles 11 years or older, Montana issues permanent plates, eliminating renewals.

This strategy avoids California's sales tax, use tax, and VLF, benefiting high-value vehicles, RVs, and classic car collections. Professional services handle LLC formation, DMV paperwork, and compliance, completing the process in 3-6 weeks without travel to Montana.

Cost Comparison

California Costs for a $75,000 Class A Motorhome:

Sales tax: $6,375 (8.5% average)

Registration: $320

VLF: $488 annually

Smog transfer fee: $8

Title fee: $15

First-year total: $7,206

Annual renewals: $808

Montana LLC Costs:

LLC formation: $995

Registration: $87

Plates: $30

Total: $1,112

No annual renewals

Five-year savings: ~$10,000

Classic Car Collection (Three Vehicles, $120,000 Total Value):

California: Sales tax ($10,200), registration ($120), VLF ($780 annually). First-year total: $11,100; annual renewals: $900.

Montana LLC: LLC formation ($995), registration ($261). Total: $1,256; no renewals. Five-year savings: ~$14,000.

Military Humvee:

California: Import documentation ($500), inspections ($800), compliance research ($1,200), registration/taxes ($3,500). Total: ~$6,000.

Montana LLC: LLC formation ($995), registration ($87). Total: $1,082. Savings: ~$5,000.

Legal Considerations

LLC registration is legally recognized, but vehicles primarily used in California may face tax obligations. Proper LLC documentation and business formalities ensure compliance. Insurance must name the LLC as the owner and list authorized drivers, which may affect premiums. Professional consultation is recommended for complex cases.

Why Choose Street Legal Hookup

Street Legal Hookup has successfully helped thousands of vehicle owners navigate complex registration requirements while saving substantial money through legal Montana LLC registration.

Our team specializes in the unique challenges facing motorcycle, RV, and specialty vehicle owners. We understand the specific requirements for California motorcycle compliance, the complexities of custom vehicle registration, and the legal frameworks supporting Montana LLC registration.

Proven Track Record

Our experience includes successful registration of military vehicles, imported motorcycles, custom RVs, and street legal motorcycle modifications. We've handled cases involving complex compliance requirements and unique vehicle types.

Legal Expertise

Montana LLC registration requires proper legal structure and ongoing compliance. Our team ensures your LLC meets all Montana requirements while providing the business documentation necessary to support legal vehicle ownership.

Money-Back Guarantee

We stand behind our work with a complete satisfaction guarantee. If we cannot successfully complete your vehicle registration, you receive a full refund.

Frequently Asked Questions

How much does it cost to transfer a car title in California?

The basic title transfer fee is $15 for private sales, $21 for out-of-state conversions. Total costs include sales tax (7.25%-10.25%), registration ($46-$300+), VLF (0.65% annually), and smog fees ($8-$50). First-year costs range from $1,000-$15,000.

Who pays California title transfer fees?

The buyer typically pays, though private agreements can differ. Sellers provide required documents like smog certificates and signed titles.

What documents are required?

Vehicle title, bill of sale, smog certificate (if applicable), proof of insurance, and ID. Out-of-state transfers need Vehicle Verification (Form REG 31) and proof of purchase.

How long do I have to register after moving to California?

New residents have 20 days from establishing residency; purchasers have 10 days from the transaction. Late transfers incur penalties starting at $25.

Do gifted vehicles require tax payment?

Yes, use tax is based on market value. Exemptions for transfers between spouses, parents/children, or siblings require strict documentation.

Conclusion

California's vehicle registration system is one of the most expensive in the U.S. Understanding its costs helps owners make informed decisions. Alternative strategies, like Montana LLC registration, offer legal ways to reduce costs while ensuring compliance. Savings are significant for high-value vehicles, RVs, and specialty cars. Professional guidance maximizes savings and simplifies the process.

Register or Title Your Vehicle From Any State, Stress-Free

Click below, answer a few quick questions, and start your registration in minutes.

Get Road-Ready EasilyREADY TO get street legal?

Register or Title Your Vehicle From Any State, Stress-Free.

Click below, answer a few quick questions, and start your registration in minutes.

Register or Title Your Vehicle From Any State, Stress-Free. Guaranteed

Street Legal Hookup

Register Your Vehicle

LEGAL

STREETLEGALHOOKUP.COM IS A MONTANA VEHICLE REGISTRATION COMPANY, UNAFFILIATED WITH ANY GOVERNMENT AGENCY © 2025 Street Legal Hookup Inc. All rights reserved. Privacy Policy | Terms Of Service